Total new credit granted to South African consumers increased from R102.29 billion to R109.62 billion in the second quarter of 2013, representing a quarter-on-quarter increase of 7.2%. At the same time, the number of applications for new credit increased from 10.12 million to 10.35 million, a quarter-on-quarter increase of 2.3%. Of these new applications, 56.14% were rejected, up from 50.84% a year ago.

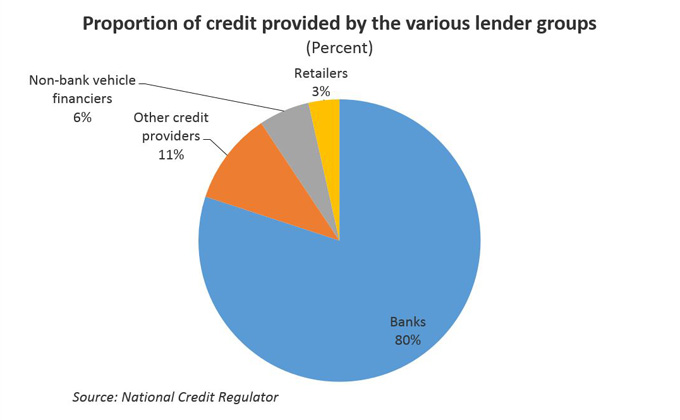

As expected, banks were the primary providers of credit in the second quarter, granting R87.73 billion or just over 80% of all new credit. “Other credit providers”, which includes pension backed lenders, developmental lenders, micro-lenders, agricultural lenders and insurers, amongst others, granted R11.61 billion (10.59%). Non-bank vehicle financiers and retailers granted R6.4 billion (5.84%) and R3.87 billion (3.53%) respectively (see Figure 1).