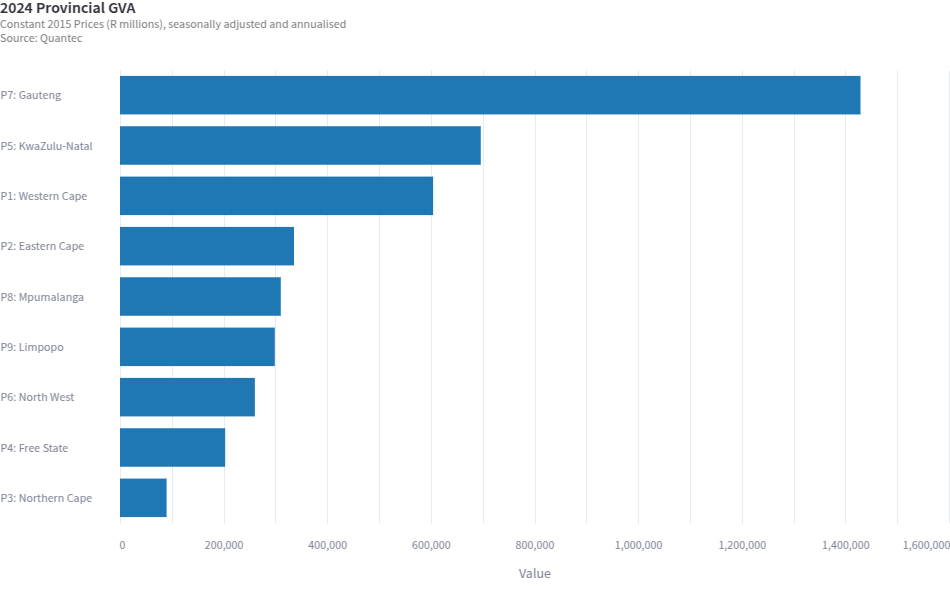

Statistics South Africa has recently released the Gross Domestic Product (GDP) figures for the fourth quarter of 2024. The data set Quarterly Provincial GDP at market prices estimates, which includes both official national accounts data and modelled estimates, provides a detailed breakdown of economic activity across major industries, offering insights into sectoral contributions to GDP at both national and provincial levels, and is available on EasyData.

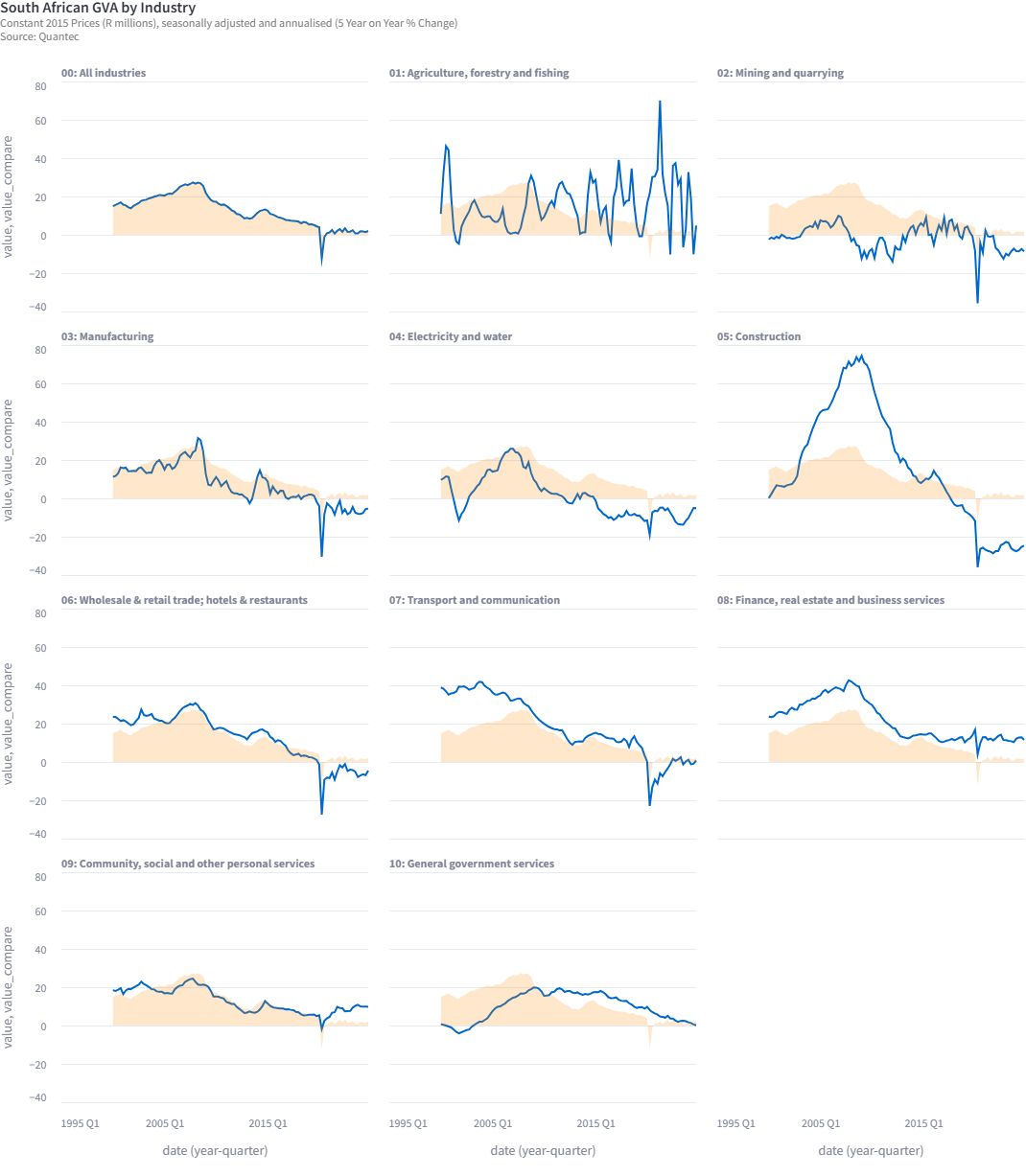

South African Gross Value Added

March 13, 2025

Key Insights

OpenAI model: gpt-4o

1. Agriculture, Forestry and Fishing:

The sector shows strong short-term growth across most provinces. Notably, the Free State (P4) and Gauteng (P7) experienced high quarterly growth rates of 19.6% and 18.7%, respectively, driven by favorable climatic conditions and stable market conditions.

2. Mining and Quarrying:

Despite minor fluctuations quarter-on-quarter, the sector is experiencing a secular decline as indicated by significant negative 5-year trends, especially in provinces like KwaZulu-Natal (P5) with a -21.6% change. This reflects structural challenges such as regulatory pressures and fluctuating commodity prices.

3. Manufacturing:

Manufacturing sectors have shown stagnant to declining performance across many regions, with negative year-on-year and 5-year trends, particularly in Gauteng (P7) where the 5-year change is -8.9%. This indicates enduring competitive pressures and cost challenges.

4. Electricity and Water:

The sector shows mixed performance. Most provinces encounter declines or stagnant growth, reflecting systemic issues like infrastructural constraints and energy supply concerns; Free State (P4) has some positive recent growth but an overall negative 5-year trend of -7.1%.

5. Construction:

Persistent long-term declines are observed in the construction sector, evident from negative 5-year changes in all provinces, with Gauteng (P7) having the steepest decline at -25.9%. This signals ongoing challenges related to investment flows and regulatory hurdles.

6. Wholesale & Retail Trade; Hotels & Restaurants:

Shows modest recovery signs year-on-year, such as in Mpumalanga (P8) at 1.9%, yet longer-term trends remain weak, suggesting subdued consumer confidence and spending levels despite gradual economic reopening.

7. Transport and Communication:

Broadly negative year-on-year performance is consistent across regions, notably in Gauteng (P7) at -5.1%. However, some provinces show potential for reversal based on positive 5-year trends, indicating future recovery opportunities possibly related to investments in digital infrastructure.

8. Finance, Real Estate and Business Services:

Robust growth was noted across most provinces, with Gauteng (P7) leading with a 5-year growth of 12.5%. This reflects the region's resilience and adaptability in the face of economic shocks, supported by strong financial markets and real estate demand.

9. Community, Social and Other Personal Services:

Demonstrates resilience with positive long-term trends, particularly in Mpumalanga (P8) with a 5-year growth of 13.4%, likely driven by public services and possibly increased demand for non-essential services.

10. General Government Services:

Generally stagnant, with most provinces showing minimal or negative growth both year-on-year and over 5 years, highlighting fiscal constraints and limited public sector expansion.

Anomalies:

Agriculture: Despite generally positive trends, Limpopo (P9) shows a decline in yearly performance at -3.6%, possibly reflecting regional-specific challenges such as drought conditions.

Electricity and Water: Several provinces including the Northern Cape (P3) and Free State (P4) exhibit negative trends. These indicate inefficiencies or infrastructural weaknesses unique to these regions.

General Trends: The markedly negative 5-year trends in sectors like construction and mining reflect systemic challenges adding to the post-COVID recovery complexities.

Quantec News

About Quantec

Quantec is a consultancy providing economic and financial data, country intelligence and quantitative analytical software.

Recent news

New Exciting StataNow Features! - 13 Nov 2025

Stata's Upcoming Free Specialised Webinars - 25 Sep 2025

Stata's New Power Logistic Command - 26 May 2025

Stata Specialised Webinars in June, July and August - 15 May 2025

Construction Materials Suppliers - April 2025 - 06 May 2025

Stata 19 is here! - 10 Apr 2025