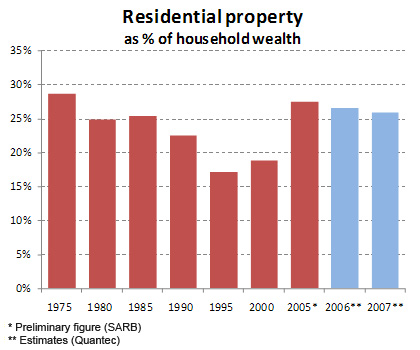

According to the South African Reserve Bank, households held 27,5% of their total assets in residential properties in 2005. This was up from the 1995 level of 17,2%, but still slightly below the 28,7% level of 1975.

Household wealth trends

January 17, 2008

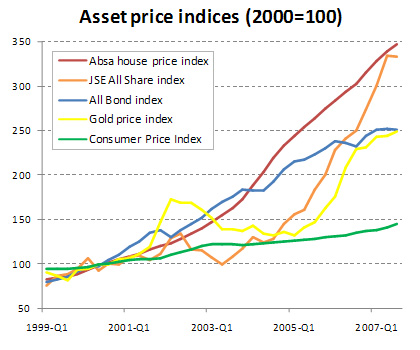

Generally speaking, South African households have experienced significant increases in their net worth levels owing to some exceptional increases in property values, while listed shares have also experienced spectacular capital growth since 2004. Most asset classes have appreciated in real terms.

Over the past five years, the average annual nominal capital appreciation rates of some prominent asset classes and inflation were as follow:

- Absa house price index: 23,5%

- JSE All Share index: 20,9%

- All Bond Index: 11,6%

- Gold price index (rands): 8,1%

- CPI: 4,4%

Of course, to these capital appreciation rates, periodic income that is paid in terms of interest, dividends or rental income, should be added.

Over the decade ending in 2005, selected household wealth variables performed as follow (real average annual % change):

- Total assets: 5,4%

- Tangible assets: 8,2%

- Financial assets: 4,2%

- Mortgage advances: 8,1%

- Net worth: 5,3%

Quantec News

About Quantec

Quantec is a consultancy providing economic and financial data, country intelligence and quantitative analytical software.

Recent news

EViews 14 released - 25 Jun 2024