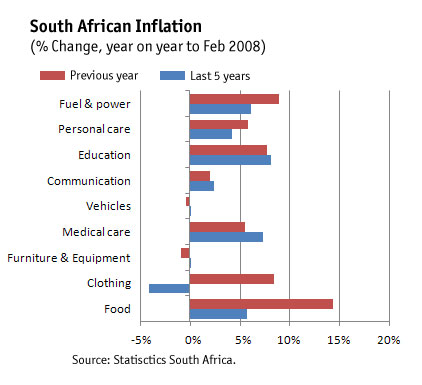

Food prices, which accounts for 25,7% of the total basket of goods and services in the CPIX, rose by 14,3% y/y in February 2008. Over the past five years, the average inflation rates of some of the most important CPIX categories are indicated in the graph. It is interesting to note that, medical care, education, and fuel and power have all increased by more than food did.

Notes on the escalation in food prices

April 16, 2008

Food prices are rising globally

Food price inflation has not been contained to South Africa. Over the past two years, global food prices have risen by 67% in dollar terms. The Economist Intelligence Unit's (EIU) index for food, feedstuffs and beverages (FFB) is estimated to have risen by 38% in 2007.

Reasons for escalating food prices

- Adverse weather conditions in key production areas, such as drought (last year in Australia) and floods (in Argentina);

- Climbing input costs related to planting, harvesting and transport because of soaring fuel costs;

- Surging biofuel demand because of sky-high oil prices and the switching of production to this lucrative business;

- Higher incomes in India and China have made hundreds of millions of people wealthy enough to afford meat and other foods. According to the Economist, in 1985 the average Chinese consumer consumed 20kg of meat a year; now he consumes more than 50kg. This has caused farmers to switch, and they are feeding their animals about 200 - 250 million more tonnes of grain than they did 20 years ago.

- Reduced crop acreage and declining stocks have also been responsible for part of the upswing in prices, and world cereals stocks as a proportion of production are the lowest ever recorded. The run-down has been accentuated by the decision of large countries (America and China) to reduce stocks to save money.

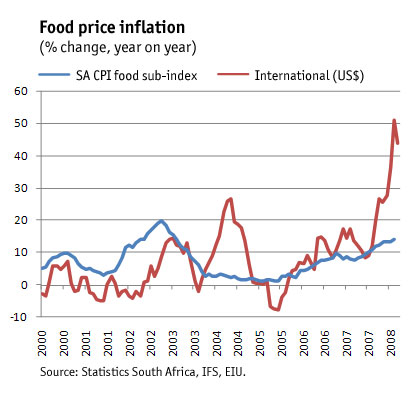

Food price inflation: SA vs world prices

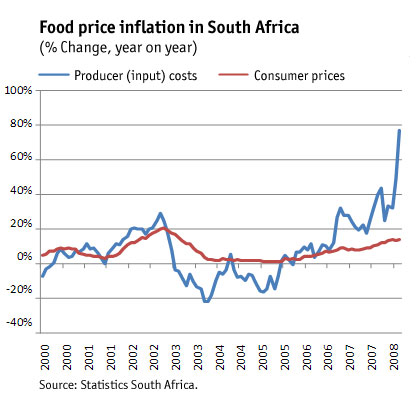

Consumer price inflation for food has been benign, compared to what has happened globally. Over the past year (February 2008)the global food price index has soared by 51% in dollar terms, compared to only a 14,1% increase in SA food prices (CPI). Given the drop of more than 6% in the value of the rand against the dollar, this relatively small inflation differential is even more remarkable. What is more, at the producer level, food products have risen by no less than 77% during the past year (February 2008).

Impact on low-income households

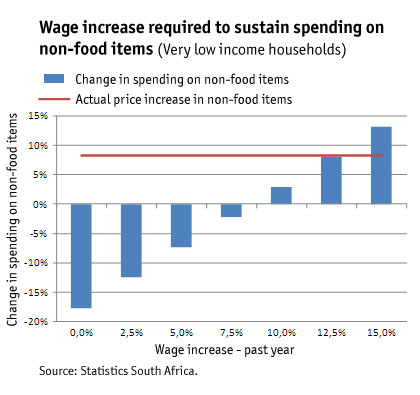

According to StatsSA, very low income households spend on average 51,2% of their income on food. Moreover, during the past year, the price of their food basket would have risen by 16,7%. This would also imply that, even if they have received a wage increase of, say 7,5% over the past year, their spending on non-food purchase would have declined if they maintained the same volume of food purchases. To have been able to maintain their volume purchases of both food and non-food items, very low income households must have a received a wage increase of around 12,5% during the past year as indicated in the graph below.

Outlook

As the markets are also expected to remain tight in 2008, The Economist Intelligence Unit (EIU) forecasts that the food, feedstuffs & beverages (FFB) index will grow by a further 27%. In 2009 prices will ease by a mere 4%, owing mainly to weakness in the beverage markets. Large investments in bio-fuel capacity and strong demand for feed/food use have left both the oilseeds and grain markets thinly stretched. Extreme weather conditions and reduced plantings (often owing to competition for acreage in favour of more lucrative crops) have led to smaller crops, causing prices for wheat and soybeans, for example, to reach record highs. Market deficits have resulted in declining stock levels and prices are estimated to have risen in 2007 by 46% for oilseeds and 51% for grains. Both indexes will rise strongly again in 2008 as output (coupled with depleted stock levels) continues to struggle to meet demand. Assuming weather conditions allow supply to make a full recovery in 2009, this will be followed by some easing.

According to the EIU, beverage prices are estimated to have risen by around 15% in 2007, representing the sixth consecutive year-on-year increase. Depleted stocks for robusta coffee and uncertainty about the outlook for the Brazilian crop are supporting coffee prices, and African crop shortfalls, owing to dry weather, are boosting cocoa prices. In 2008 the supply response should turn positive, allowing markets to return to balance. As stocks build up, this will be reflected in a decline in prices in 2009. As usual, forecasts are vulnerable to climatic changes: the arrival of another El Niño global weather phenomenon could seriously alter production and price prospects, as could a return to civil war in Côte d'Ivoire, for example.

Quantec News

About Quantec

Quantec is a consultancy providing economic and financial data, country intelligence and quantitative analytical software.

Recent news

Stata 19 is here! - 10 Apr 2025

South African Gross Value Added - 13 Mar 2025

New Agriculture Data Sets - 22 Jan 2025