During the second quarter of 2008, annualised South African bond returns [1] came in at -21.6% in rand terms, and registered -9% in dollar terms. This means that in dollar terms, bond returns have been solidly negative over a one year and three year period as well, with returns of respectively -12.7% and -2.6% registered over these periods. However the situation has clearly turned around in the third quarter of 2008, with R157 bond yields dropping by around 160 basis points during July and August. In contrast JSE All-share index earnings yields rose by around 190 basis points — from 6% in May, to 7.9% by the end of August.

Time to sell bonds?

September 11, 2008

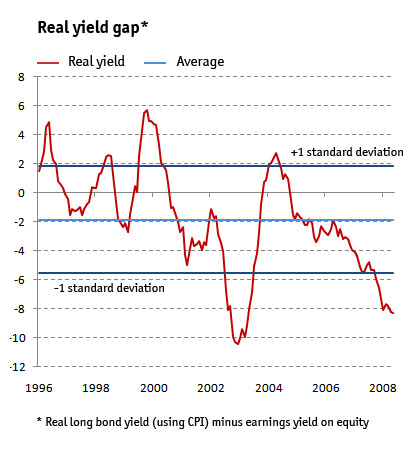

The difference between the yield-to-maturity on bonds and the earnings yield on equity (shares) is often used as an indication of the relative valuation of bonds vs. equity. As can be seen from the graph, bonds appeared to be now quite overvalued against equity. This is only the second time since 1996 that such a decisive break out of the "normal" range has occurred. This might mean that it could be time to sell bonds or buy equity.

Escalating inflation numbers and rising short-term interest rates over the past two years, have not been kind to bond market returns. The R157 (2015 13.5%) bond yield rose from 9.17% at the end of the first quarter 2008, to 10.87% three months later. But the yield on bonds have become hugely negative—to the tune of around -3.5% in August 2008 after CPI inflation rose to no less than 13% in July 2008, with the expectation that Augusts figure may rise even further.

Some bullishness has returned to the market since the end of June and bonds were further boosted by the SARB's MPC decision on 14 August to keep the repo unchanged at 12%. Although the upper turning point in inflation is expected to occur by September or October 2008, some factors remain a concern which may prevent bond yields from declining much below 8.5%.

Firstly the supply of bonds is bound to increase during the remainder of fiscal 2008/09, with the Government budgeting for long-term funding in excess of R5bn, compared with a net repayment of long-term debt of R4bn in 2007/08.

Secondly, the capital investment programme, including the Eskom recapitalisation programme and various other major infrastructural projects, are likely to see a steep rise in funding requirements and hence bond issues during the next few years. This is bound to keep bond prices under pressure.

Thirdly, the market is bound to be disappointed by the January drop in the inflation number after some analysts have optimistically estimated the drop in CPI-inflation to be as large as two percentage points. This follows the revision of the CPI basket on a new basis and the re-indexing of series to a new base year.

However, the new rules pertaining to a national pension fund system and limitations on early withdrawal, may ensure a ready investment market for government paper in 2009.

Lower inflation (projected to average around 6.5% in 2009) will certainly support the lower trend in bond market yields, so at this stage there appears to be little reason to fear a significant drop in bond prices. Therefore one can assume that equity prices could be poised for a correction within the next few months. Presumably most of the equity counters battered by high interest rates and inflation stand to benefit, which will of course be concentrated in the industrial and financial share indices.

Notes

[1] One has to distinguish between total (bond) returns, and what is normally referred as the bond yield. The former is made up of changes in capital values (prices) plus coupon payments on the bond. The latter refers to the yield-to-maturity which fluctuates in the opposite direction to prices. If an investor buys and keeps a bond until it matures, the total return will equal the yield-to-maturity over the holding period.

Quantec News

About Quantec

Quantec is a consultancy providing economic and financial data, country intelligence and quantitative analytical software.

Recent news

South African Gross Value Added - 13 Mar 2025

New Agriculture Data Sets - 22 Jan 2025