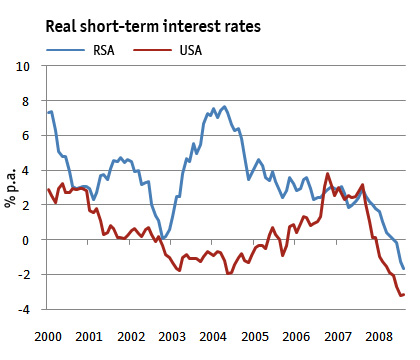

The Reserve Bank left interest rates unchanged at both their August and October 2008 MPC meetings, despite an acceleration in inflation. The prime interest rate is still at 15,5%, five percentage points higher than at the beginning of 2006. However, despite this increase in nominal interest rates, real interest rates (nominal interest rates less inflation) have dropped sharply in South Africa, just as they have in the USA. In August 2008, real interest rates (as measured by the three-month bankers' acceptance rate) were at their lowest levels since 1988. In the USA, real interest rates have been negative since the beginning of 2008.

Interest rate prospects

October 14, 2008

It would appear that the concerted effort by the world's central banks to try and stem the financial crisis by slashing interest brought only a very short respite to the fear and panic that have gripped investors and sent markets tumbling over the past few weeks, and on Thursday, 9 October 2008, Wall Street experienced its biggest single day loss since 1987. This shows that more rate cuts may be in the offing, with a zero-interest rate policy now no longer a far-fetched possibility.

| Monthly repayment for every R10,000 borrowed at prime rate | |||

| Term | End 3rd quarter 2007 | End 3rd quarter 2008 | End 3rd quarter 2009 (forecast) |

| 6 months | R1,735.38 | R1,742.82 | R1,732.90 |

| 12 months | R897.87 | R904.94 | R895.52 |

| 5 years | R232.68 | R240.53 | R230.10 |

| 20 years | R124.35 | R135.39 | R120.74 |

Table 1: Monthly repayment for every R10,000 borrowed at prime rate

As far as the South African situation is concerned, there are signs that higher interest rates and the National Credit Act are starting to impact on credit extension and the growth in the money supply. Although total credit extension (including that to the government) remains high at 26% y/y, credit extension to the private sector slowed to 21,8% y/y in July 2008 whereas M3 money supply growth amounted to 15,4%. Mortgage advances rose by 17,6% y/y, whereas instalment and hire purchase finance rose by 11,3% y/y. Although these rises are still high in nominal terms, the rates of increase are, on average, about ten to twelve percentage points lower than the cyclical highs of 2006/07.

During the past year or so, inflation has been fuelled by food and fuel prices. Both of these factors have diminished considerably in importance in keeping domestic prices under pressure. Oil prices have already declined by about a third from their peak in July this year and food prices are sure to start reacting to the movement in international food prices soon. According to The Economist's price index, international food price increases have slowed from just over 50% y/y in June 2008 to 15,3% in August. However, the sharply weaker rand is now adding another potentially serious inflationary factor to the eqaution and could postpone any rate cutting plans that the monetary authorities may have had.

On balance, it would nevertheless appear that the upper turning point in the interest rate cycle has been reached. But relief in the form of lower interest rates is unlikely to come before the second Monetary Policy Committee meeting of 2009. The Reserve Bank is likely to decide to keep interest rates at their current levels for the next six months or so (repo rate of 12%). The first rate decline could take place in April 2009, whereas interest rates could drop by about 300 basis points in the eighteen months to follow that.

It is fairly certain that the demands of Cosatu and the SA Communist Party for the review or abolition of inflation targets and that employment should become a "target" of monetary policy will unleash a heated debate next year. The fact that no country has been able to achieve sustained growth by accommodating inflation, nor has any country been able to harness monetary policy to create jobs for millions of unemployed people who lack the necessary experience or skills, does not seem to make much of an impression on the left's demands in this regard.

Quantec News

About Quantec

Quantec is a consultancy providing economic and financial data, country intelligence and quantitative analytical software.

Recent news

EViews 14 released - 25 Jun 2024