As usual, most analysts have again heaped praise on Finance Minister Trevor Manuel for the clever way in which he managed to profess his continued commitment to prudent fiscal policy in the 2009 Budget, while also acknowledging and allowing for the effects on SA of the current global economic recession (which he warned could become a depression).

Steep increase in the deficit: Unavoidable stabilisation measure, or an ominous structural break?

February 18, 2009

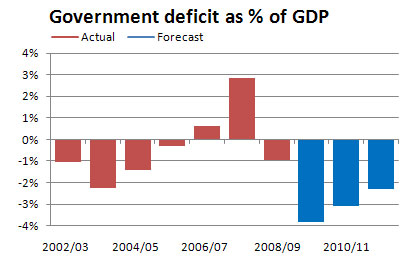

The SA fiscal deficit is projected to rise to 3,9% of GDP in 2009/2010, compared with a budgeted surplus of 0,6% in 2008/09, and the actual projected outcome of a deficit of 1%. Amidst soaring state aid and grants internationally to certain sectors and even nationalisation of institutions in some countries, the South African Budget can indeed be seen as being fairly conservative, given the context. However, there are a number of worrying features of the present state of affairs — both in SA and internationally — which beg some closer scrutiny.

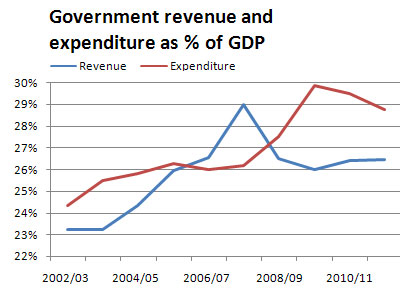

The first has to do with the growing role of the state in the economy. A number of years ago, the SA government committed itself to limiting government expenditure to 25% of GDP. However, this has not happened, and government's share in the economy had risen to 27,5% by 2008/09, and is projected to rise to 30% of GDP in the 2009/10 fiscal year. Both this ratio and the deficit ratio could turn out to be even higher, given the very optimistic 1,2% growth forecast assumed in the Budget for 2009/10. The reason for limiting the state's role in the economy has to do with efficiencies and incentives. Since the incentives to spend taxpayer money efficiently are small and even non-existent in many instances, the state is often unable to produce goods and render services of the same quality as the private sector. The ailing South African Airways which now has to rely on yet another bail-out package (worth R1,6 bn) by the government is a good case in point.

This brings up the second point, namely the question of whether it was wise to budget for an increase of 16,5% in government expenditure, rather than allowing for more tax breaks and budgeting for an even smaller increase in government revenue. The problem with increasing government expenditure is that it is easy for such spending to become entrenched and difficult to cut back on it later on. Politically, it is virtually impossible to cut back on any form of social grants and welfare payments. In an environment where there are ineffective or insufficient controls and incentives to ensure efficient spending by government departments, the return on bigger government spending is quite uncertain, and almost guaranteed to be lower than the potential benefits that could arise from a reduction in tax rates — especially company taxes.

Thirdly, there is the matter of the extent to which the rising deficit and debt ratios may lead to a reduction in SA's sovereign risk rating and also the possibility of higher debt servicing costs, which could imply higher long-term interest rates as well. Although SA's debt-to-GDP level is projected to remain below 28% over the next three years, it is still anticipated to increase by nearly 5 percentage points as a ratio of GDP. What is more, any deficit level that remains significantly above the rate of economic growth, can quickly lead to a situation where the debt burden becomes unsustainable, fuelling inflation and subduing economic growth.

The aim of the 2009 Budget appeared to be clearly directed at the counter-cyclical stimulation of the economy. The track record of Minister Manuel has been exemplary and based on this, there should be little to fear from a possible entrenchment of higher state spending, and a structurally higher deficit and debt ratios for South Africa. However, if the minister's tenure is not extended after the upcoming elections or any political opportunistic changes are effected to the National Treasury, markets could well be unsettled and the country could pay a high price in terms of declining confidence levels.

Author: Christo Luüs

Quantec News

About Quantec

Quantec is a consultancy providing economic and financial data, country intelligence and quantitative analytical software.

Recent news

New Exciting StataNow Features! - 13 Nov 2025

Stata's Upcoming Free Specialised Webinars - 25 Sep 2025

Stata's New Power Logistic Command - 26 May 2025

Stata Specialised Webinars in June, July and August - 15 May 2025

Construction Materials Suppliers - April 2025 - 06 May 2025

Stata 19 is here! - 10 Apr 2025