During the first quarter of 2013, South African motorists paid some 13,5% more for fuel compared with a year ago. March and April saw further increases of, on average, R1,56 per litre on 95 octane petrol before the latest 73c reduction which became effective in May 2013. The rand's depreciation against the dollar was mostly to blame for this situation, but the oil price which had remained stubbornly high despite a struggling world economy (Europe is still in recession) of course also played a big role.

Are we seeing the long anticipated structural break in oil prices?

May 22, 2013

International oil prices fell during the 2009 recession within a period of one year by approximately 63% in dollar terms, but thereafter rose continuously and were more than 150% higher in the first quarter of 2013 than in the first quarter of 2009. The oil price has relented somewhat during April 2013 making it around 13% cheaper than a year ago and putting it at about the same level as two years ago, but it is still around 130% more expensive than during the height of recession in 2009 and 35% more expensive than in 2010.

There were forecasts that the world's oil production will fall dramatically within a decade or two and that oil wells will be exhausted reasonably shortly thereafter. The rising oil price, despite sluggish economic conditions and global pressure to limit the emission of harmful gasses, are thus regarded by many analysts as proof that oil production has reached its upper limit and that it may possibly start to decline soon. This could cause even more upward pressure on oil prices.

However, figures released annually by BP do not really support this scenario. On the contrary, BP's figures show that known oil reserves in 1991 were estimated at 1 033 million barrels. By the end of 2011, known reserves were 60% higher at approximately 1 653 million barrels. This is sufficient, at current consumption levels, to supply the world for another 54 years.

It is clear, however, that there are important changes taking place in the world production of oil. In December last year the USA's oil imports were at their lowest levels in 16 years and 30% lower than the peak of 10,8 million barrels per day recorded in 2005.

The slightly weaker USA economy plays a role in this, but the most important reason for the declining oil imports by the USA is that its own domestic oil production increased sharply. In 2012 the USA produced 9,1 million barrels of oil per day, an increase of 12% compared with the previous year. Progress relating to drilling techniques which involves rock fracturing that can reach oil trapped in deep rock formations, was the biggest contributor to this development. Saudi Arabia, Nigeria and Angola's oil exports to the USA were the most affected by the declining dependence of the US on imported oil. However, these oil producing countries' increased exports to countries such as India and China more than compensated for the US becoming more self-sufficient.

The expectation is that the USA's production over the next few years will continue to increase at a faster pace than the country's consumption of oil and that the USA would probably become self-sufficient as far as oil consumption is concerned. The latter forecast is probably somewhat over-optimistic and continued mining of hard-to-reach oil and natural gas resources will only happen if oil prices remain high enough.

High and higher oil prices are probably the world's destiny as the extraction of the remaining oil reserves becomes progressively more expensive. It will require ever more energy to extract hard-to-reach oil and natural gas resources. In addition, fracturing is an expensive process with many risks as far as damage to the environment and underground water resources are concerned.

South Africa's imports of crude and processed oil and petroleum products are still the biggest import category and comprised 21,3% of the country's total goods imports in 2012. In value terms these imports were approximately R177 billion.

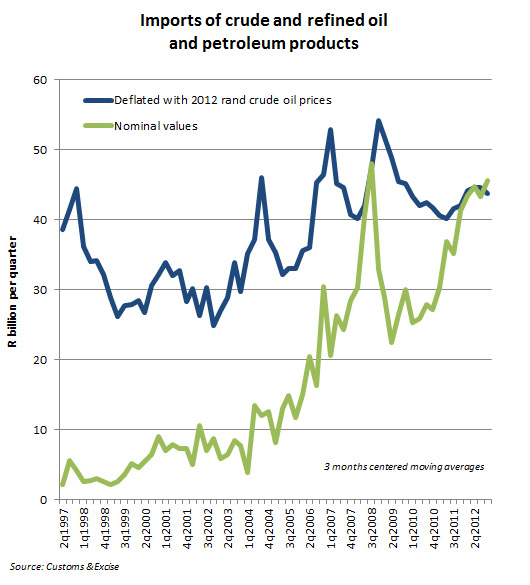

What is interesting is the fact that since the first quarter of 2009 up to and including the final quarter of 2012, oil related imports increased by 58% in nominal rand value, while the volume of these imports declined by 27%. (See graphs)

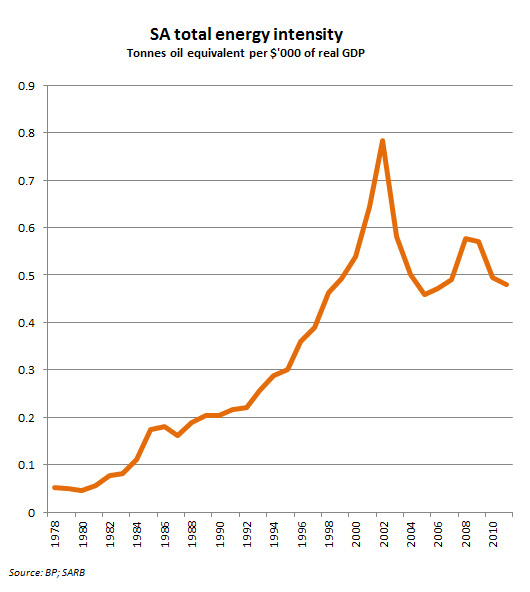

This means that South Africa's oil consumption intensity fell rather sharply during the past year. This supports the figures of BP that show that South Africa's total energy consumption intensity fell by 39% in 2011 since peaking in 2002.

Nevertheless South Africa's energy-intensity is still considerably higher than that of developed countries and more will have to be done to develop and encourage the use of sustainable energy resources. It is extremely important - especially in view of the fact that electrical power is getting more and more expensive - that the country's dependence on fossil fuels be further reduced. It will not only help to reduce the emission of harmful gasses, but also affect our trading account positively.

Oil price increases after the 2009 recession did have much to do with the recovery of some developed economies and most developing/emerging market economies. But geopolitical risks, such as the ongoing tensions surrounding Iran's nuclear ambitions and the potential disruption that could be caused to global oil supplies should Iran close the Strate of Hormuz, have probably also played some role. Although it would not appear that a structural break in oil prices have now propelled oil irrevocably to above $100/bl forever, there are enough systemic and geopolitical risks present which could potentially affect either the supply- or the demand-side to ensure a volatile oil price for many years in the future.

Author: Christo Luüs

Quantec News

About Quantec

Quantec is a consultancy providing economic and financial data, country intelligence and quantitative analytical software.

Recent news

Stata's New Power Logistic Command - 26 May 2025

Stata Specialised Webinars in June, July and August - 15 May 2025

Construction Materials Suppliers - April 2025 - 06 May 2025

Stata 19 is here! - 10 Apr 2025

South African Gross Value Added - 13 Mar 2025